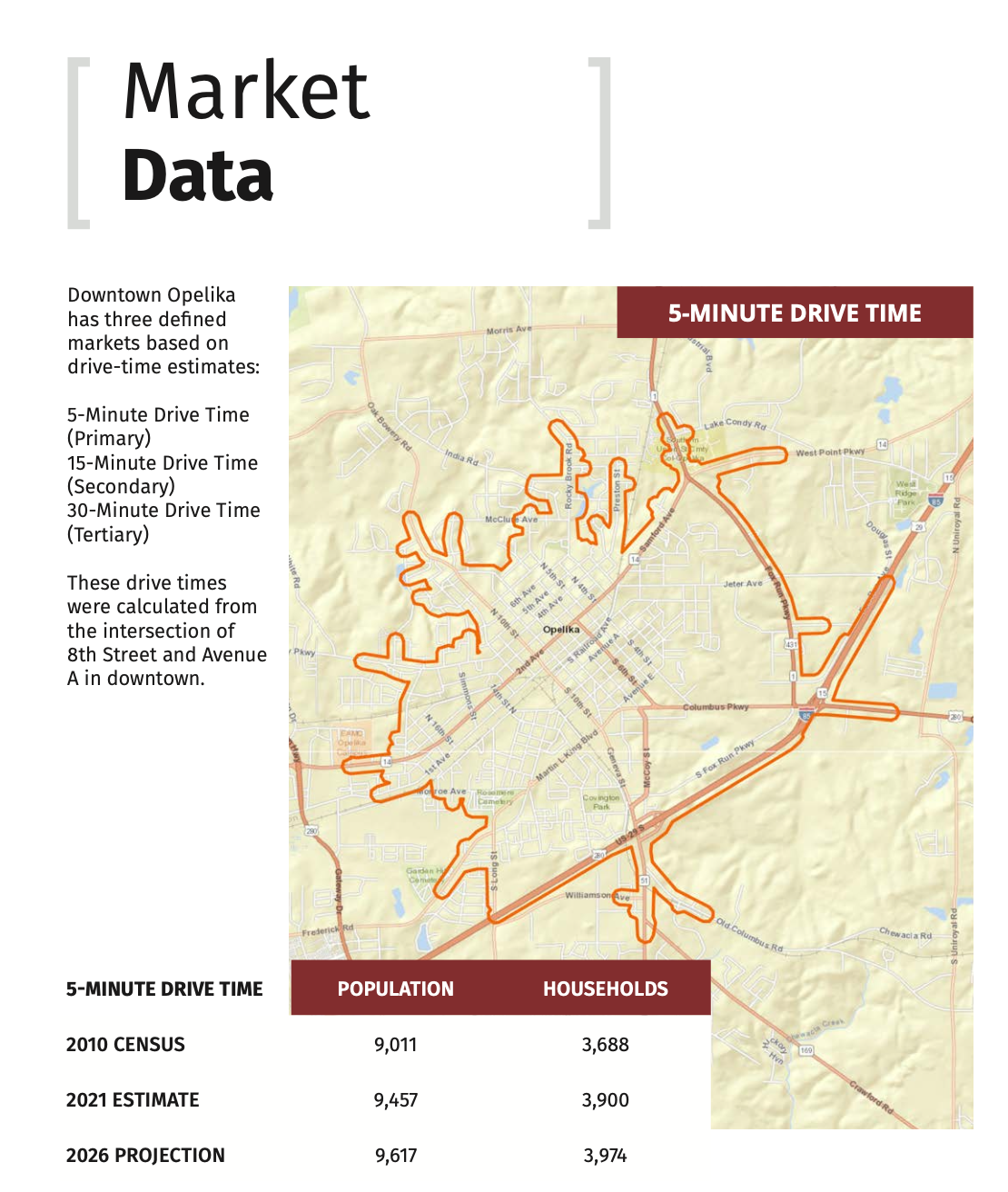

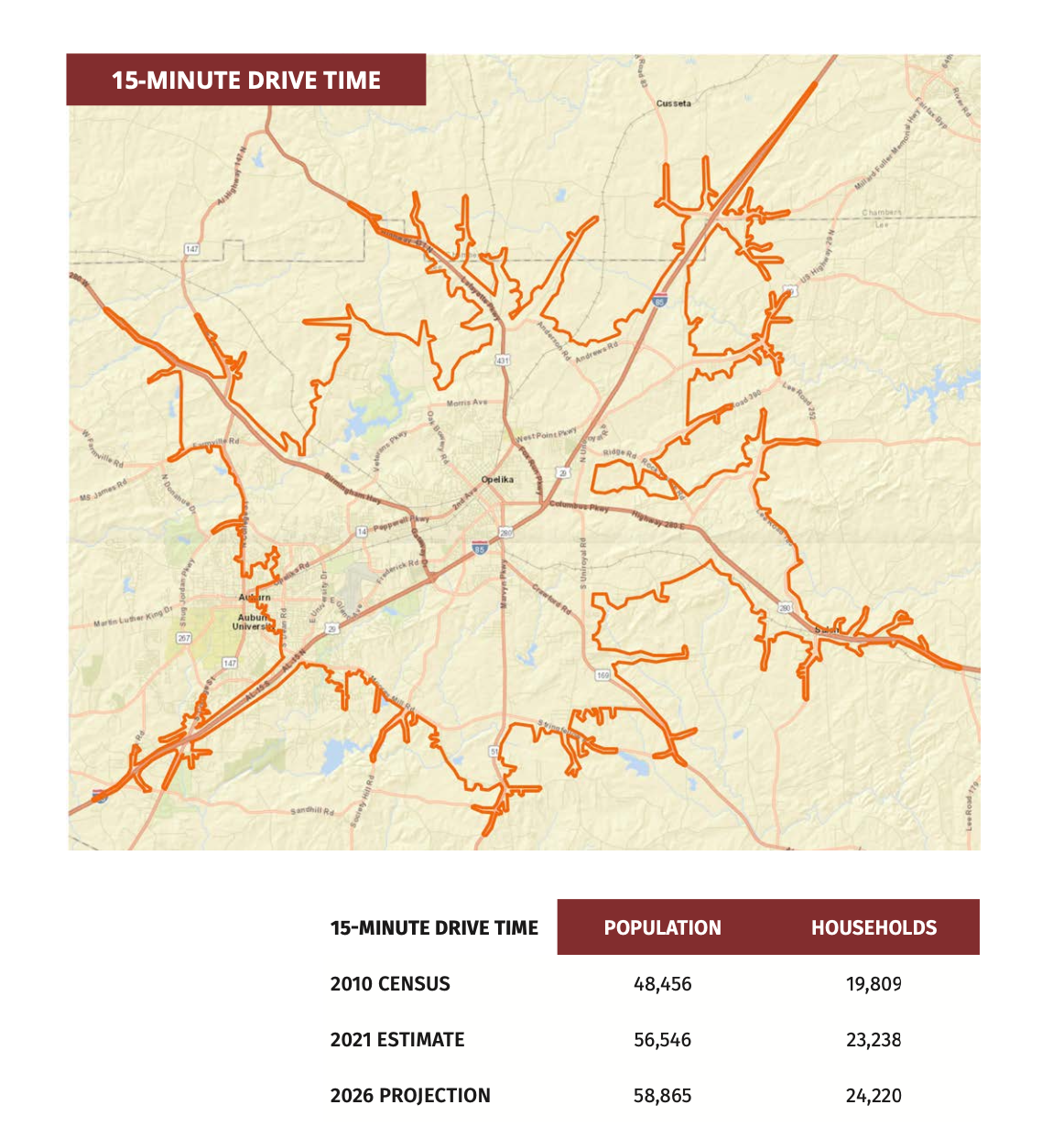

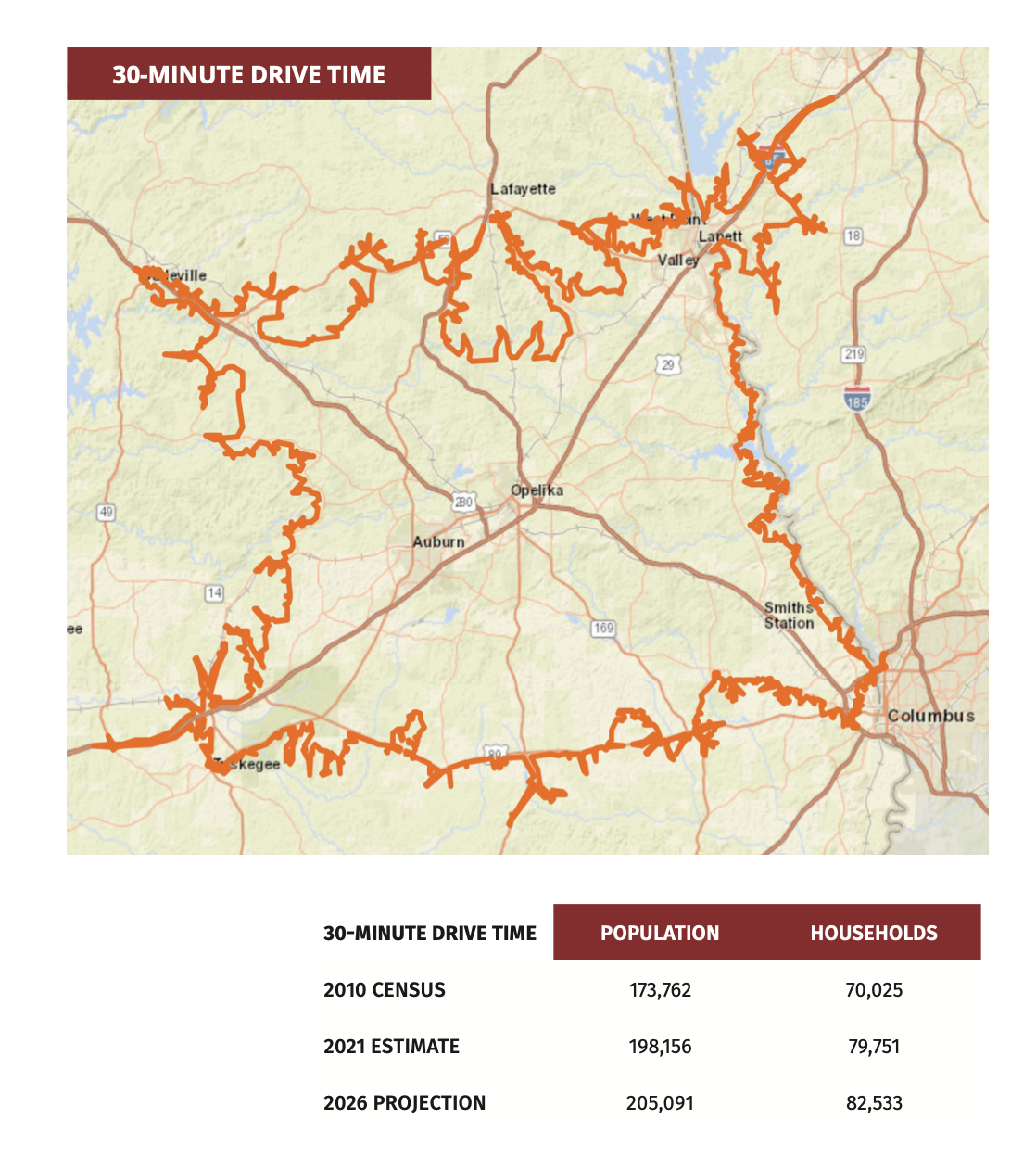

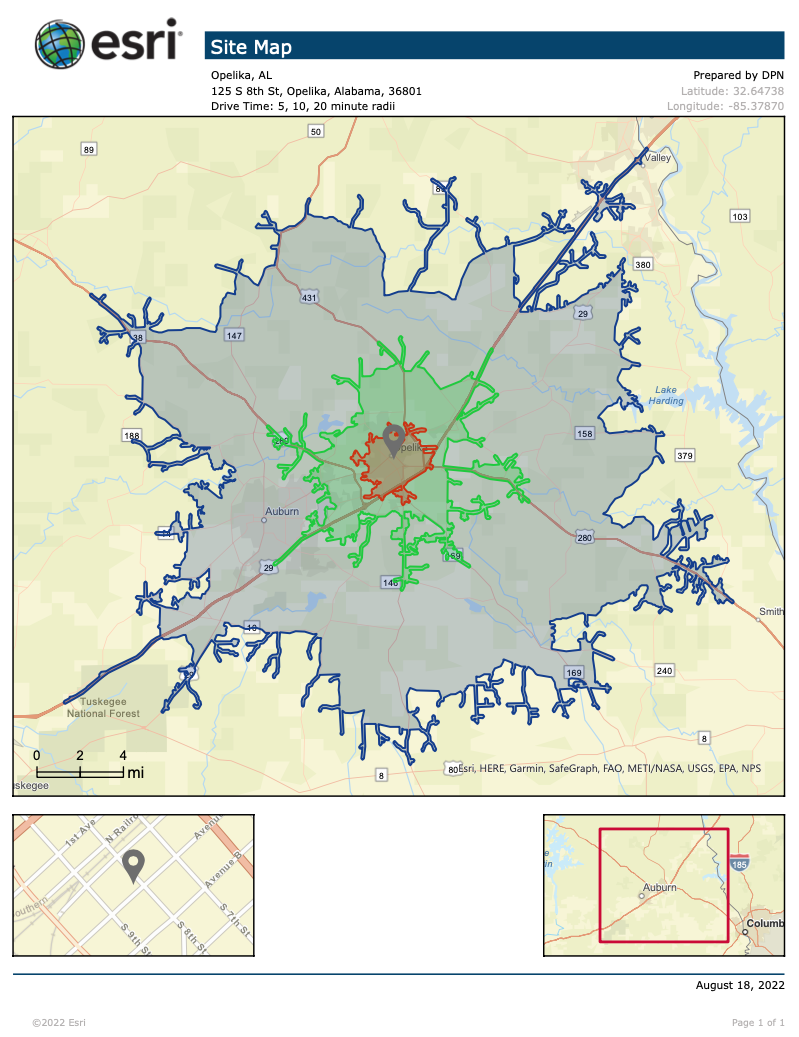

Opelika and Lee County consistently rank as one of the fastest growing regions in the Southeast. Opelika is considered the retail and commerce hub of the region, attracting large numbers of shoppers from Lee and surrounding counties.

Home to Southern Union State Community College and in close proximity to Auburn University, Opelika has a highly educated workforce. Additionally, a large student population lives within close proximity to downtown.

Grants & Incentives

Bill Roberts Facade Enhancement Grant

Business owners in the Downtown Historic District may qualify for up to $7000 in matching grant funds through Opelika Main Street’s Bill Roberts Facade Grant Program to perform exterior repairs. Repairs that have been funded in the past include: painting, awning replacement, window/trim work and brick repairs.

A limited number of funds are also available for applicants needing termite abatement or treatment.

Contact Opelika Main Street for More Information!

Alabama Historic Rehabilitation Tax Credit

The Alabama Historic Rehabilitation Tax Credit is a 25% refundable tax credit available for private homeowners and owners of commercial properties who substantially rehabilitate historic properties that are listed in or eligible for the National Register of Historic Places and are 60 years old or older. The tax credit provides jobs, increases the tax base, and revitalizes existing buildings and infrastructure, while preserving and rehabilitating Alabama’s historic properties.

FEDERAL REHABILITATION TAX CREDIT

The Federal Historic Preservation Tax Incentives program is the largest Federal program that specifically supports historic preservation and is one of the nation's most effective programs to promote historic preservation and community revitalization.

The National Park Service is the federal agency that administers the program, and the AHC is the point of contact for anyone who applies for tax credits for properties in Alabama. The Historic Preservation Certification Application must be submitted (in duplicate) to the AHC to certify that the property is eligible for the program and that proposed work meets historic rehabilitation guidelines.

Properties must be listed in the National Register of Historic Places. Part 1 of the application determines if the property is eligible for the program.

Properties must be income-producing after rehabilitation.

Rehabilitation expenditures must be substantial.

Rehabilitation work must follow the Secretary of the Interior’s Standards for Rehabilitation. Part 2 of the application determines if proposed work follows preservation guidelines. Part 3 is submitted after completion of the project.

Properties must remain income-producing for five years.

Applicants meeting these requirements may earn an income tax credit that equals 20% of qualified rehabilitation expenditures. Property owners interested in these tax credits are advised to consult an accountant, tax attorney, or other professional tax adviser, legal counsel, or the Internal Revenue Service to ensure this program is beneficial to them.

Lee Russell Council of Governments Revolving Loan Program

The fund provides low-interest, long-term financing to small and medium-sized businesses.

The program is intended to fill the gap between what the bank can lend and what the borrower can provide in equity.

This fund helps to create and maintain jobs within the Lee and Russell County borders.